Better Sleep Council research reveals what motivates higher-priced mattress purchases and how accessories complete the sale.

Grabbing the attention of shoppers who are willing to pay $2,500 or more for a mattress has never been more important than it is today. A soft consumer market makes every sale count.

But what do these shoppers want? What will encourage them to splurge on a mattress?

The latest research from the Better Sleep Council, which leads consumer research for the International Sleep Products Association, takes a deep dive into the topic. It compiled answers from an online survey of 500 U.S. adults who had either recently purchased or planned to purchase a mattress that costs $2,500 or more.

In July, BedTimes shared demographics — who was likely to buy higher-priced mattresses, how much they spent or expected to spend, why they sought beds priced at $2,500 or more, and what price point was considered too much. If you missed that article, you can read it here.

This month, we’ll look at triggers for mattress replacement, consumer shopping preferences, information sources and accessory shopping while buying a mattress at a higher price point.

Triggers for High-End Mattress Shopping

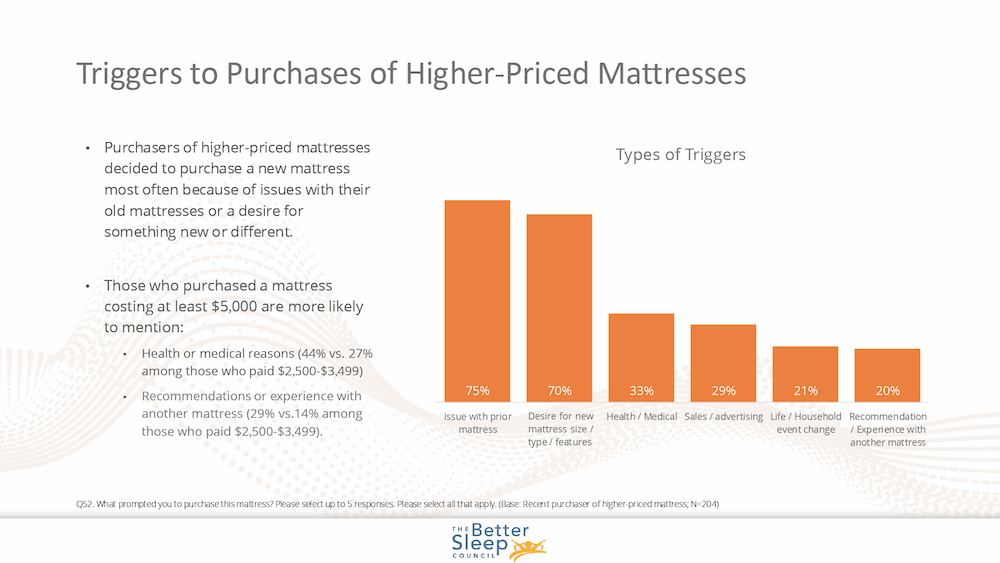

A majority of respondents (75%) said issues with their current bed drove them to start mattress shopping, followed by a desire for something new (size, materials or features). Previous BSC research shows this to be true for all consumers.

Respondents also cited health and medical reasons (33%), sales or an ad (29%), a life event or household change (21%), and a recommendation or experience with another mattress.

And where do people most often experience other mattresses? In a hotel or resort.

When asked if they learned about a mattress brand from a hotel or resort nearly four in 10 purchasers agreed. Of those who strongly agreed, 53% purchased a mattress priced at $7,500 or more.

The survey also asked those who are planning to purchase a higher-priced mattress in the next few years about whether they were considering a mattress brand they had tried at a hotel or resort and nearly half agreed. Like their purchasing counterparts, 41% expected to buy a mattress that costs $7,500 or more.

Those who shopped or are planning to shop for a higher-priced mattress sometimes use or plan to use an interior designer. The higher the price of the mattress, the more likely an interior designer is involved in the decision. For example, 19% of those who purchased a $2,500-plus priced mattress used an interior designer. Almost half of them purchased a bed that cost $7,500 or more. Another interesting tidbit — men are more likely than women to report using an interior designer (25% of men vs. 12% of women). If you’re in the luxury arena, it’s a good idea to partner with designers — they sway brand selection and are influential in purchasing decisions.

How High-End Shoppers Research Mattresses

How do consumers learn about the brands they purchase?

Those planning to buy a higher-priced mattress thought they would rely on customer or user reviews the most (46%), followed by in-store displays of mattresses (44%) and web searches (42%). Respondents were asked to choose up to seven responses from a list of 20 options. But those who recently purchased a higher-priced mattress cited in-store displays of mattresses as the most helpful, along with customer and user reviews, and family or friend recommendations.

| Key Takeaways |

|---|

| 1. Product dissatisfaction is the No. 1 trigger to shop. 2. Hotels are powerful brand discovery tools. 3. Interior designers play a role in ultra-premium sales. 4. Consumers trust both online research and in-store experience. 5. High spenders are more influenced by social media and video. 6. Brick-and-mortar remains strong but online sales are growing. 7. Boxed mattresses appeal even to high-end buyers. 8. Upselling opportunities abound with accessories. 9. Adjustable bases are becoming a must-have at higher price points. |

Once again, the price point made a difference in how the question was answered. Those who planned to purchase or purchased a mattress for at least $5,000 were more likely to say social media and online videos were helpful sources of information.

Where Luxury Mattress Shoppers Buy

With a plethora of places to purchase a mattress — both in-person and online — where do people shop?

Of those who recently bought a higher-priced mattress, 66% said they purchased it in a brick-and-mortar store and 34% said online. The most popular in-person shopping experience was a mattress specialty chain store, like Mattress Firm (29%). The second most common was a furniture store (19%). For the online shoppers, 20% bought their mattress at a general online retailer like Amazon or Overstock and 17% purchased from a mattress retailer that sells mostly online, like Casper.

More than half of all higher-priced mattress purchasers chose white glove delivery service, with those spending from $2,500 to $3,499 being the most likely to choose this option (63%). Purchasers in the $5,000 and above range also preferred white glove delivery (44%), but a higher percentage also chose to have it-delivered by carrier (32%) or brought it home themselves (23%) than those who spent less.

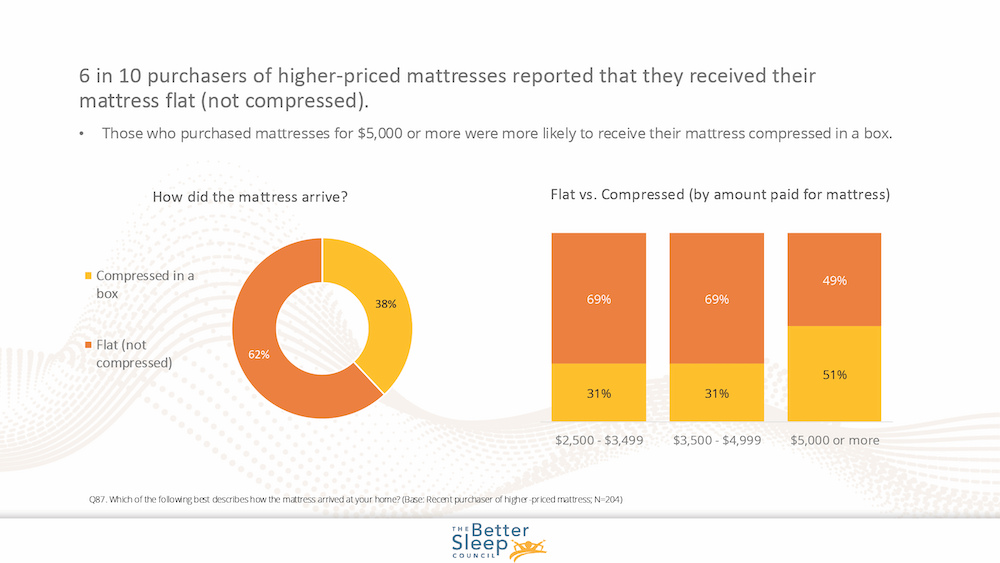

Do you have a guess as to how many chose to have their mattresses delivered flat versus rolled and compressed? The answer might surprise you.

First, the less surprising statistic: 62% of all higher-priced purchasers received their mattresses flat while 38% got their bed compressed in a box.

When broken down by price, the numbers are interesting. The majority of those who bought beds that cost from $2,500 to $4,999, received them flat (69% vs. 31%). But those who spent $5,000 or more were almost equally divided. A slight majority (51%) purchased a boxed bed, while 49% received a flat mattress.

Completing the Sale with Accessories

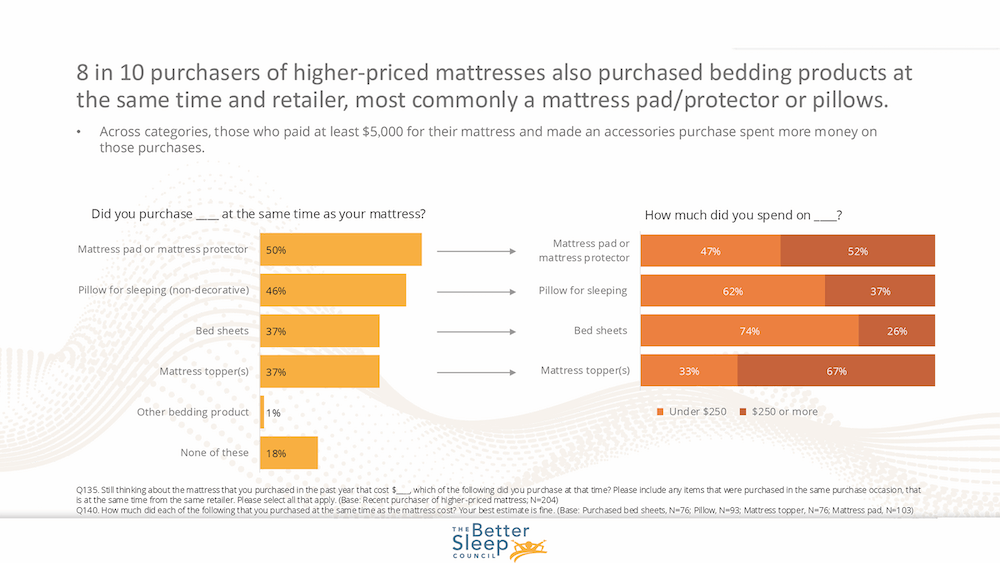

After spending a significant amount of money on a mattress, these shoppers also invested in bedding accessories.

A new foundation was at the top of many consumers’ lists. Of those who recently purchased a higher-priced mattress, 33% bought an adjustable base. The percentage is higher for those who spent more than $5,000 — 44%. And 33% bought a new box spring or foundation.

Of those planning to buy a new mattress in the next few years, 37% said they were planning to buy a new box spring or foundation and 20% expect to buy an adjustable base.

Top-of-bed items also made the list. Half of purchasers took home a mattress pad or protector along with their mattress. They also bought new pillows (46%), sheets (37%) and mattress toppers (37%). Only 18% did not purchase anything extra.

Based on the BSC survey, manufacturers can glean that having a variety of options is important to these consumers.

“Today’s luxury mattress shoppers aren’t just buying a bed — they’re investing in an experience,” said Mary Helen Rogers, ISPA vice president of marketing and communications. “From discovering brands in upscale hotels to layering on adjustable bases and premium bedding, these consumers are thoughtful, discerning and willing to spend more for better sleep.”

The full BSC report is available to ISPA members. Email [email protected] for a copy.