Estimated reading time: 9 minutes

Editor’s Note: The following article provides analysis and a forecast for the U.S. economy in general. It is not intended to provide a forecast specifically for the mattress industry. Also, the predictions in this article do not necessarily reflect the views of the International Sleep Products Association.

Manufacturers can look forward to a gradually improving, if challenging, operating environment in 2026. “The U.S. economy is holding up admirably well despite a major trade shock caused by tariffs,” said Bernard Yaros Jr., lead U.S. economist at Oxford Economics. “We look for an acceleration in growth in 2026 as stimulus from the One Big Beautiful Bill gets underway.”

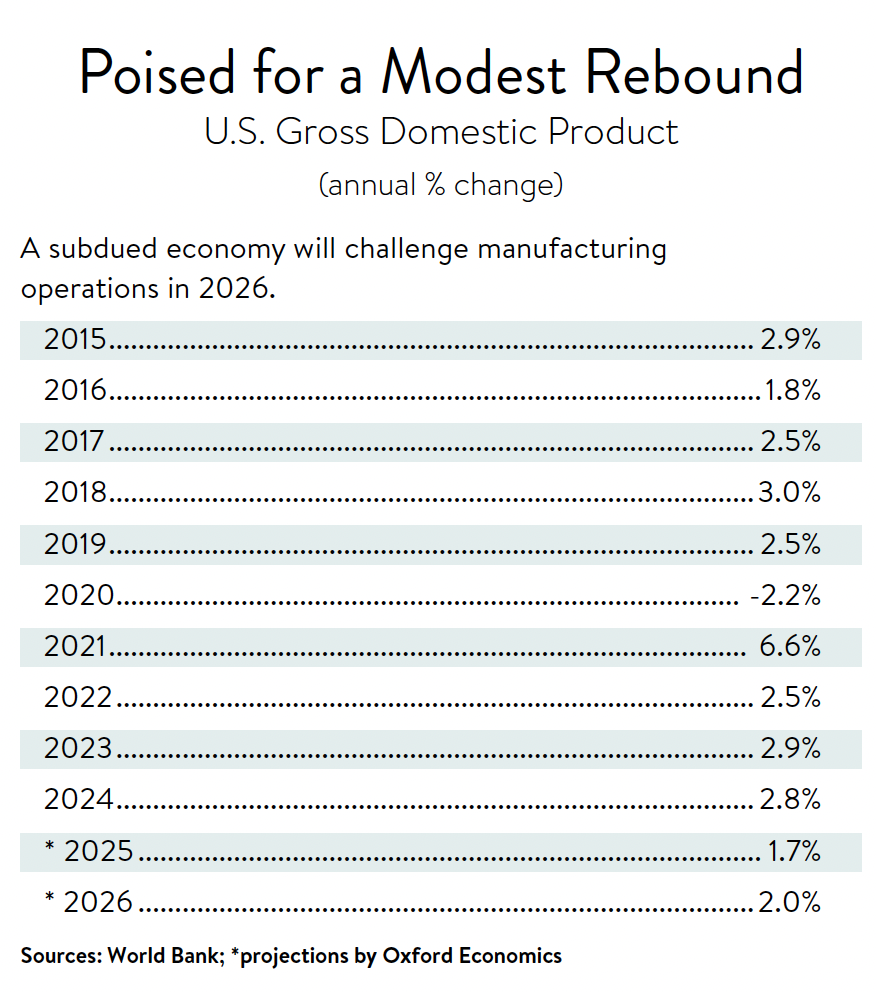

Oxford Economics, based in Oxford, England, with U.S. headquarters in New York, expects real gross domestic product to grow by 2% in 2026, up a bit from the 1.7% expected when 2025 numbers are finally tallied. Both years — among the most sluggish growth environments of the past decade — are expect-ed to underperform the 2.8% GDP increase of 2024. (GDP, the total value of the nation’s goods and services, is the most commonly utilized measure of economic growth. Real GDP subtracts the effects of inflation.)

Aiding Growth: Stimulus, Trade Clarity, and Improving Credit Conditions

The nation’s economic growth depends largely on the launch of new business initiatives. Unfortunately, manufacturers are holding back for a number of reasons. Interest rates, while declining, are still at the highest levels since 2022. Costs for ma-terials and supplies are increasing. There is uncertainty about the nation’s future trade policy. Lower- and middle-income consumers, nervous about inflation, are tapped out and closing their wallets. Against such headwinds, a host of otherwise at-tractive projects can look less promising.

One might also expect business profitability to suffer. Yet Ox-ford Economics expects it to follow the same general pattern as the GDP. “We look for corporate profits to rise by 4.9% in 2026,” Yaros said. “That’s up substantially from the 0.5% expected when 2025 numbers are finalized.” Even so, the 2026 pace remains slower than the 7.9% profit growth clocked in 2024.

The expected 2026 rebound in profitability stems from a be-lief that stimulus from Washington, D.C., will lift all boats. “We believe the passage of the One Big Beautiful Bill, with its tax cuts for businesses and households, should help the economy regather some steam in early 2026,” said Anirban Basu, chair and CEO of Sage Policy Group, an economic and policy consul-tancy based in Baltimore. The legislation’s 100% bonus depre-ciation should help fuel business investment, while large tax refunds should invigorate consumer spending. Both activities are important drivers of the nation’s economy.

This federal stimulus is arriving at the same time manufac-turers are getting a more solid footing on the nation’s shifting trade policy. “There has been a bit of a shock to the system in and around tariffs over the past year, and it is taking some time for many companies to understand their impact,” noted Andrew Petryk, head of industrials at Brown, Gibbons Lang & Co., an investment bank headquartered in Cleveland.

Specifically, companies have responded to China tariffs by sourcing imports from other countries — a move that has also helped the nation’s recent supply chain ills. “Lead times have diminished as companies have found alternative or additional suppliers,” Petryk said. “Those that relied on one or two vendors now have three, four or five.”

Manufacturers should also benefit from a decline in the cost of money over the coming months, as the Federal Reserve shifts its focus from fighting inflation to bolstering employment. “We look for inflation to peak at just above 3% when 2025 numbers are finalized, and for the Fed to cut interest rates into 2026 until the federal funds rate falls to about 3%,” Yaros said. That rate, while much higher than the rates of early 2022, is a considerable improvement over the 4.3% of mid-2025.

Declining interest rates, which encourage businesses to launch new initiatives, are also a reflection of looser pockets on the part of the nation’s lenders. “Credit conditions have improved significantly for businesses,” Basu said. “Companies with strong balance sheets will find bankers very willing to supply debt. We also know that equity investors, including private equity, remain quite aggressive in supplying capital.”

Analyzing Continued Headwinds in the Housing Sector

Speaking of lower interest rates, they can’t come soon enough for a major driver of the nation’s economic activity: the housing sector. “Housing is in a funk,” Yaros said. “Single-family homebuilders are contending with a growing supply of unsold, completed new homes, as well as greater competition from the resale market and falling home prices in a rising number of regions.”

The high cost of money is not helping matters. “A significant increase in interest rates since the summer of 2022 has increased the monthly payments required from buyers of new or existing homes,” Petryk said. “They have also led to a significant market shortage because families who bought homes three- to five-plus years ago are loath to surrender their sub-3% mortgages.”

Mortgage rates have an important impact on the consumer attitudes that are vital drivers of the economy. While lower short-term rates may be coming from the Federal Reserve,

it’s unclear how much effect they will have on the longer-term ones that apply to the funding of new homes. “I do not forecast mortgage rates coming down enough to make a big difference in single-family construction,” said Bill Conerly, principal of his

own consulting firm in Lake Oswego, Oregon.

Wary builders. Reluctant sellers. Sluggish buyers. It’s all having an effect on the housing market. Oxford Economics expects housing starts to fall by 4.3% in 2025 and decline by another 2.3% in 2026 after dropping by 3.5% in 2024. Prices for existing homes are expected to increase only 1.5% in 2025 and 2.3% in 2026 after rising by 4.4% in 2024.

Concerned about the rising cost of living, consumers are cutting back on spending of all kinds. Their hesitancy affects the retail sector, which is an important driver and bellwether of the economy. “Our forecast for year-over-year retail sales growth is 3.8% for 2026, down from the 4.5% of 2025,” said Scott Hoyt, senior director of consumer economics for New York-based Moody’s Analytics. Much of those increases in both years is due to inflation. “High prices are a bit of a mixed bag,” Hoyt said. “They undermine consumer purchasing power and confidence, but they also support nominal sales by lifting the prices of the goods retailers are selling.”

Varied Outlook for Nonresidential Construction: Data Centers vs. Other Sectors

Outside of the single-family home market, contractors are having problems of their own. Multifamily builders, working through a backlog of units under construction, are hesitant to break ground on new ones. “I think we’ll see less multifamily construction in 2026,” Conerly said. “Vacancy rates are going up and rents have been coming down at the rate of about 1% a year.”

Meanwhile, contractors attached to the commercial, office and hotel markets are feeling the sting of a slowing economy, high interest rates and an environment rife with uncertainty. “Many areas of nonresidential are trending at or edging down,” Conerly said. “Even the chip fabs (factories that manufacture semiconductor chips), while still strong, are tapering down.”

The one bright construction sector: data centers. They show no signs of diminishing and are big customers for electricians, plumbers and suppliers of scaffolding and manufactured products of all kinds. “When I look at the detail and the economic statistics of what kind of capital equipment is being bought, I am seeing a lot of data center-related equipment in there,” Conerly said. “Data centers also require a lot of garden variety wiring, connectors and plumbing for cooling.”

Every sector of the construction industry shares a common challenge: labor availability. Oxford Economics forecasts an unemployment rate of 4.4% and 4.3% at the end of 2025 and 2026, respectively. That’s not much higher than the 4.1% clocked at the end of 2024. Low unemployment, largely due to slowing growth in the nation’s working age population and aggressive immigration policies, can result in rising labor costs.

Navigating High Costs and Preserving Cash Flow in 2026

For all business sectors, money and labor are not the only production factors on the rise. “The real problem is the world has become much more expensive in the last few years,” Basu said. “Construction materials are more expensive. And of course there are tariffs

on items like steel, aluminum and copper.”

Little wonder the high cost of doing business is top of mind for many operators. “As we head into 2026, the area of most concern for manufacturers is profit margin,” Basu said. “Many operators are simultaneously experiencing an increase in costs of delivering

services while demand fades.”

Given the variety of business concerns, it’s little wonder that many projects are being put on hold. “It’s hard to engage in cost savings when both materials and labor are becoming more expensive,” Basu said. “Many manufacturers are responding by not expanding their operations and trying to trim expenditures at the margins. They are focusing more on cash flow preservation by slowing hiring and being less aggressive in leasing and purchasing

equipment, particularly equipment impacted by tariff pricing.” This generalized business hesitation is evidenced in the numbers. “We look for business investment to increase by only 1.6% in 2026, after rising by 3% in 2025 and 3.6% in 2024,” Yaros said.

Conclusion: Final Forecast and Indicators for the Year Ahead

As we enter the early months of 2026, economists suggest that manufacturers watch these key economic indicators for an idea of how the year will turn out:

Employment

“I would pay close attention to the unemployment rate,” Yaros said. An unexpected decline in employment would spur faster interest rate cuts as the Fed seeks to reinforce economic expansion.

Consumer spending

“How is the consumer faring?” Basu said. “Bear in mind that many low- and middle-income people are exhausted nancially. Indebtedness and delinquencies are up for credit cards, mortgages and loans.”

Inflation

“If we get stubbornly high in ation, that will prevent further progress on interest rate,” Basu said.

Oxford Economics still expects the nation to avoid a recession, and the expected 2% GDP growth is right around the level economists peg as the nation’s “natural growth rate” — one that supports business

Perhaps of even greater importance, though, is a little heralded threat to productivity. “One thing that sort of permeates the whole economic picture right now is the nation’s low population growth rate,” Conerly said. “Immigration is down, due to Trump administration

policy. The next generation entering their working years is about the same size as the retiring boomers, so there will be no net growth in the labor force.”

Responding to this trend, manufacturers will look for ways to maximize their return on labor by increasing output per worker, he noted. “The focus of businesses in 2026 will be increasing productivity — not by whipping people harder, but by providing them with better tools, better training and better managers.”